- TON caiu 14,64% no mês passado.

- Os fundamentos do mercado indicaram uma mudança no sentimento do mercado, de baixa para alta.

No último mês, o mercado de criptografia experimentou uma forte recuperação, com Bitcoin [BTC] subindo para uma alta local de $ 69k.

No entanto, durante a semana passada, o mercado esfriou, com a maioria das criptomoedas ficando negativas. Assim, as perdas recentes começaram a superar os ganhos mensais.

Uma das altcoins mais atingidas foi Toncoin [TON]. Desde que atingiu uma alta mensal de US$ 5,8, a TON sofreu um declínio significativo.

Na verdade, no momento em que este artigo foi escrito, o Toncoin estava sendo negociado a US$ 4,95. Isso marcou um declínio de 2,42% no último dia.

Da mesma forma, o altcoin caiu 14,64% mensalmente, com uma extensão desta tendência de baixa em 6,06% nos gráficos semanais.

Notavelmente, as condições de mercado prevalecentes deixaram a comunidade criptográfica deliberando sobre a trajetória do altcoin.

Um deles é o popular analista de criptografia [TON}. As such, since hitting a monthly high of $5.8, Ton has experienced a significant decline. In fact, as of this writing, Toncoin was trading at $4.95. This marked a 2.42% decline over the past day. Equally, the altcoin has dipped by 14.64% on monthly with an extension to this bearish trend by 6.06% on weekly charts. Notably, the prevailing market conditions have left the crypto community deliberating over the altcoin’s trajectory. One of them is the popular crypto analysts Ali Martinez who has suggested Ton’s current conditions provides buying opportunity. TON TD Sequential shows a buy signal In his analysis, Martinez posited that TD sequential shows a buy signal on Toncoin’s 12-hour charts. According to him, this suggests a potential price rebound in the near future. In context, what this means is that selling pressure is a warning and the bears are losing momentum. When sellers lose momentum, buyers can enter the market at lower prices thus creating buying pressure. As the buy signal has appeared, it has resulted in increased trading activities. Thus, Trading volume for Ton has surged by 126% to $313.1 million on 24-hour charts. This suggests that most likely traders are entering the market buying at lower prices. Therefore, if the market follows through, the prices will rebound and see further gains on price charts. What Ton Charts Suggest Although Ton has experienced a sustained decline, the current conditions suggest bears have exhausted and the altcoin could see gains on price charts. For example, Toncoin’s large holder’s Netflow to exchange netflow ratio has declined from a monthly high of 289% to 70%. This shows a shift in sentiment with large holders accumulating their assets as they anticipate more gains. Such a decline suggests market confidence. Additionally, Toncoin’s Aggregated exchanges total outflows have increased from a low of 1.86 million tokens to 7 million Ton. This shows that most investors are withdrawing their Ton from exchanges to store in cold wallets. Such behavior suggests that investors are confident in the altcoin’s future prospects. Simply put, Ton is experiencing a shift in market sentiment from bearish to bullish. Therefore, if this sentiment holds, Ton will reclaim a higher level. Thus, the altcoin will attempt a $5.4 resistance level in the near term. A breakout from this level will see Ton reach $5.8. However, if bulls fail to take over the market, a further decline will see a drop to $4.02.” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>Ali Martinez, who suggested that TON’s current conditions signaled a buying opportunity.

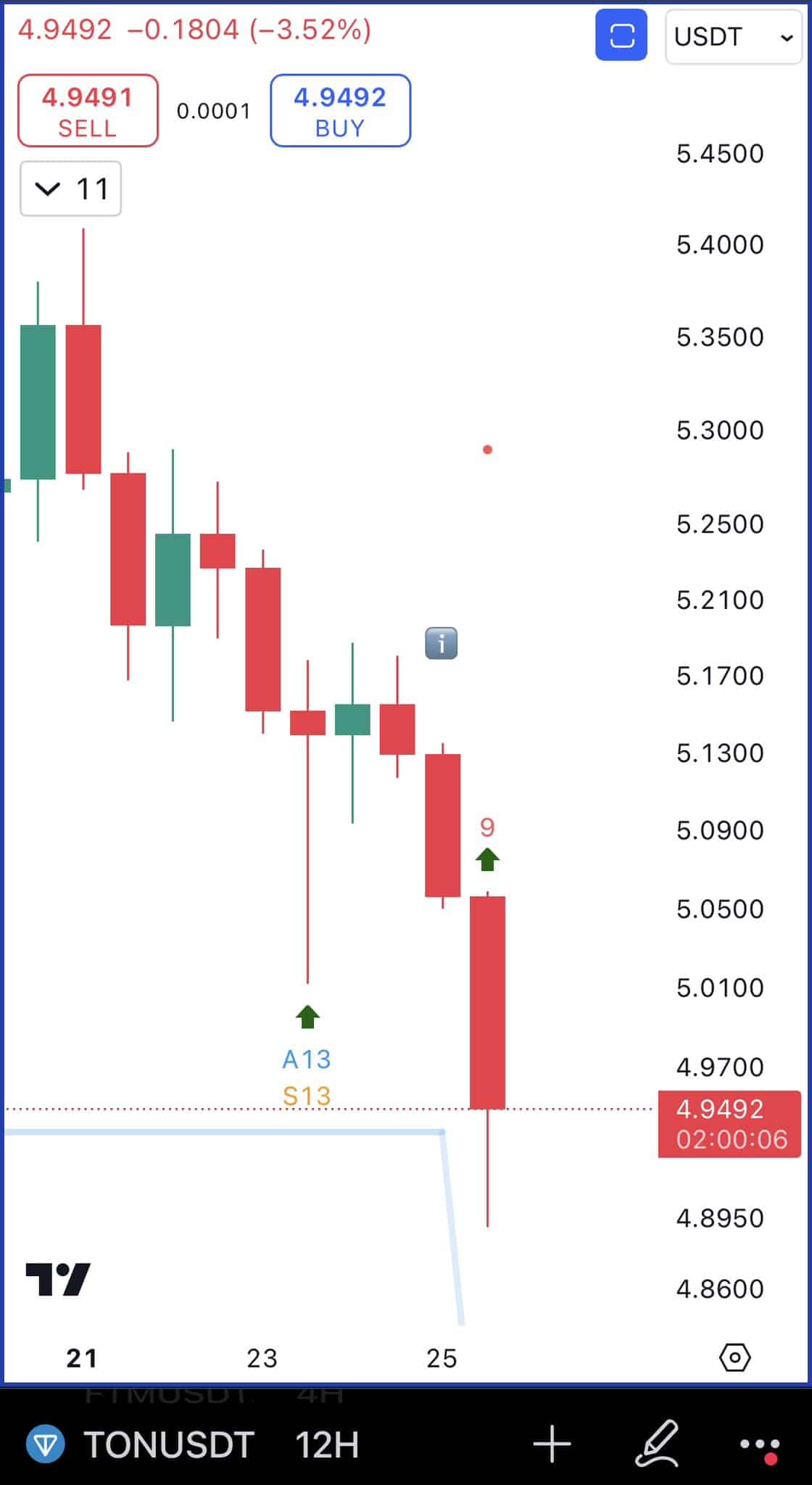

TON shows a buy signal

In his analysis, Martinez posited that TD sequential showed a buy signal on Toncoin’s 12-hour charts. This suggested a potential price rebound in the near future.

What this means is that selling pressure is a warning, and the bears are losing momentum. When sellers lose momentum, buyers can enter the market at lower prices, thus creating buying pressure.

The appearance of the buy signal has resulted in increased trading activities over the past day. Thus, TON’s trading volume has surged by 126% to $313.1 million. Thus, most traders were entering the market at lower prices.

If the market follows through, the prices will rebound and see further gains on price charts.

Gains ahead?

Although TON has experienced a sustained decline, the current conditions suggested that the bears were, and the altcoin could see some gains ahead.

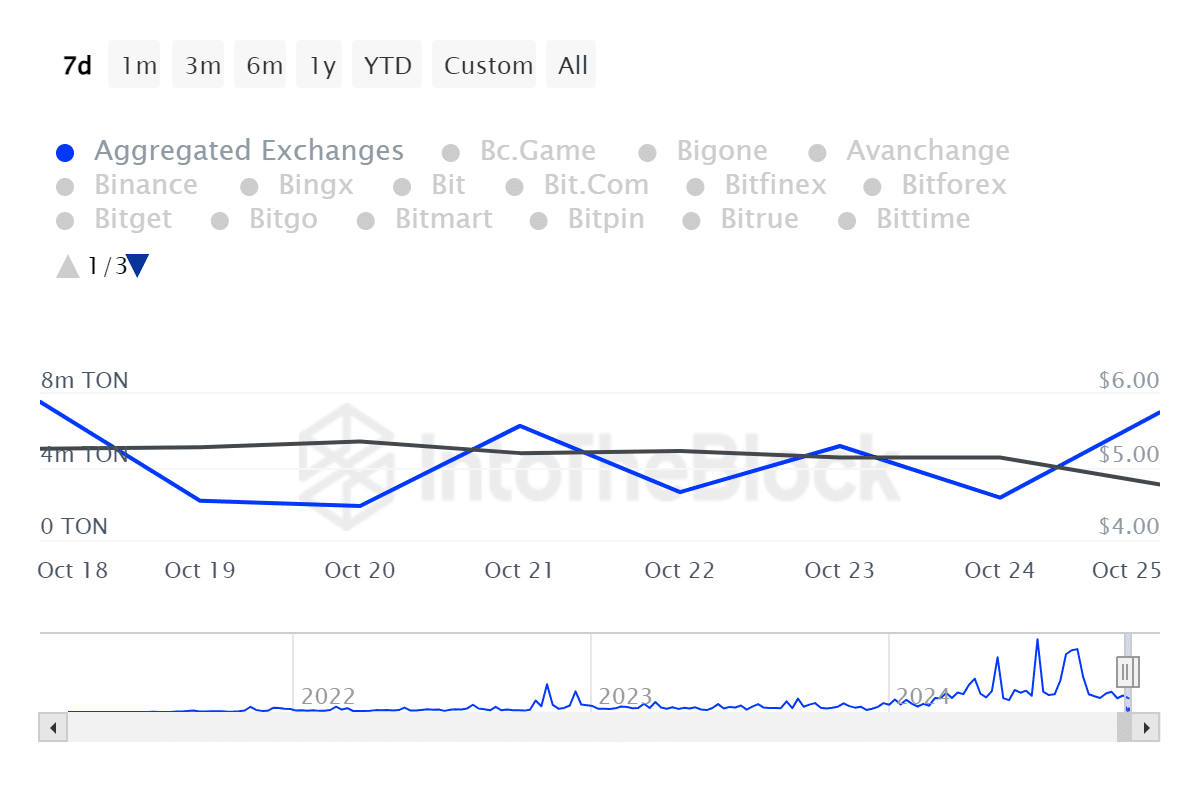

For example, Toncoin’s large holder’s Netflow Ratio has declined from a monthly high of 289% to 70%. This showed a shift in sentiment, with large holders accumulating their assets as they anticipated more gains.

Such a decline suggested market confidence.

Additionally, Toncoin’s total outflows on Aggregated Exchanges increased from a low of 1.86 million tokens to 7 million.

This showed that most investors were withdrawing their Ton from exchanges to store in cold wallets. So, investors seemed confident in the altcoin’s future prospects.

Read Toncoin’s [TON] Previsão de preço 2024–2025

Simplificando, a TON estava passando por uma mudança no sentimento do mercado de baixa para alta até o momento. Se este sentimento se mantiver, Ton recuperará um nível mais elevado.

Assim, o altcoin poderia tentar um nível de resistência de US$ 5,4 no curto prazo. Um rompimento deste nível fará com que Ton alcance US$ 5,8. No entanto, se os touros não conseguirem dominar o mercado, um declínio adicional fará com que a TON caia para US$ 4,02.